Send us a message

Get In Touch

- No 16, Kalaimagal Nagar, 1st Main Road, Ekkaduthangal, Chennai - 600032

- +91 8939000056

- kfisenquiry@gmail.com

Find Us

A great option to consider is an best unsecured business loan. Free Collateral Get approval within 72 hrs for your best unsecured business loans which offers flexibility and convenience without requiring collateral.

Any kind of business can avail Unsecured Business Loan which is the quick and easy process only based on annual income of a business. The Best unsecured Loan is a loan that does not require any collateral security, Instead of relying on a borrower’s assets as security, unsecured business finance based on a borrower’s credit worthiness.

Kfis stands out as a trusted provider in this sector, offering tailored solutions for businesses of all sizes. With their professional approach, they guide entrepreneurs through the application process, ensuring quick approval and competitive interest rates.

Taking advantage of Kfis’ unsecured loan can empower businesses to seize opportunities, expand operations, and address unexpected expenses, ultimately fueling growth and success. So, if you’re looking for a hassle free finance solution, consider Kfis as a reliable partner in your entrepreneurial journey.

Kfis offers an array of business loan solutions & The unsecured MSME business loans with no collateral and maximum loan amount upto 5CR. designed to meet the unique needs of entrepreneurs and business owners. Whether you’re looking to fund a startup venture or expand an existing business, Kfis provides flexible loan terms, competitive interest rates, and a streamlined application process.

Kfis Offers MSME Business Loan Fasten your best unsecured MSME business loans free collateral to grow your business Kfis is a reliable partner that offers a professional and efficient lending solution for small and medium sized enterprises. With extensive experience in the financial industry, Kfis understands the unique challenges faced by MSMEs and tailors their loan packages to address these specific needs.

Their team of experts works closely with business owners to provide personalized support, ensuring a smooth loan application process. Kfis not only offers competitive interest rates, flexible repayment options, and quick approvals but also goes the extra mile by providing valuable guidance and advice to entrepreneurs. By choosing Kfis for your MSME Loan, you can have confidence in their professionalism and commitment to helping your business thrive.

A business loan from Kfis is the perfect solution. With their extensive experience and professional expertise, Kfis understands the unique financial challenges that business face. Whether you need funding for expansion, equipment purchase, or working capital, Kfis offers a wide range of business loan options tailored to meet your specific needs.

Their team of finance experts is dedicated to providing personalized assistance and guidance throughout the entire loan process. With Kfis, you can rest assured that you are partnering with a reputable Finance service that prioritizes your business’s success.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco.

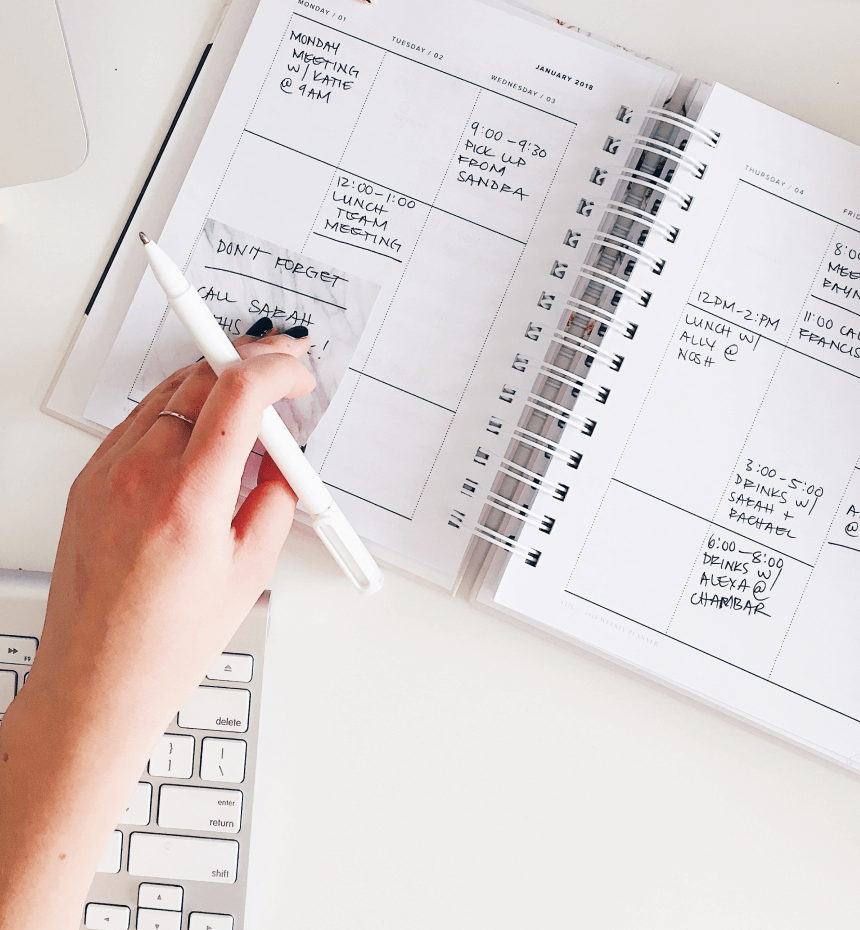

A home loan or car loan will allow you to use the money to purchase a home or car respectively. The good news is that when you apply for personal loan, it need not be restricted to a specific use. Once the loan is disbursed, you can use it for any purpose as per your particular need.

What’s more! ICICI Bank offers fresher funding loan to help you avail of a personal loan on your very first salary. With its pre-approved personal loan, the entire processing is completed in just a few minutes.