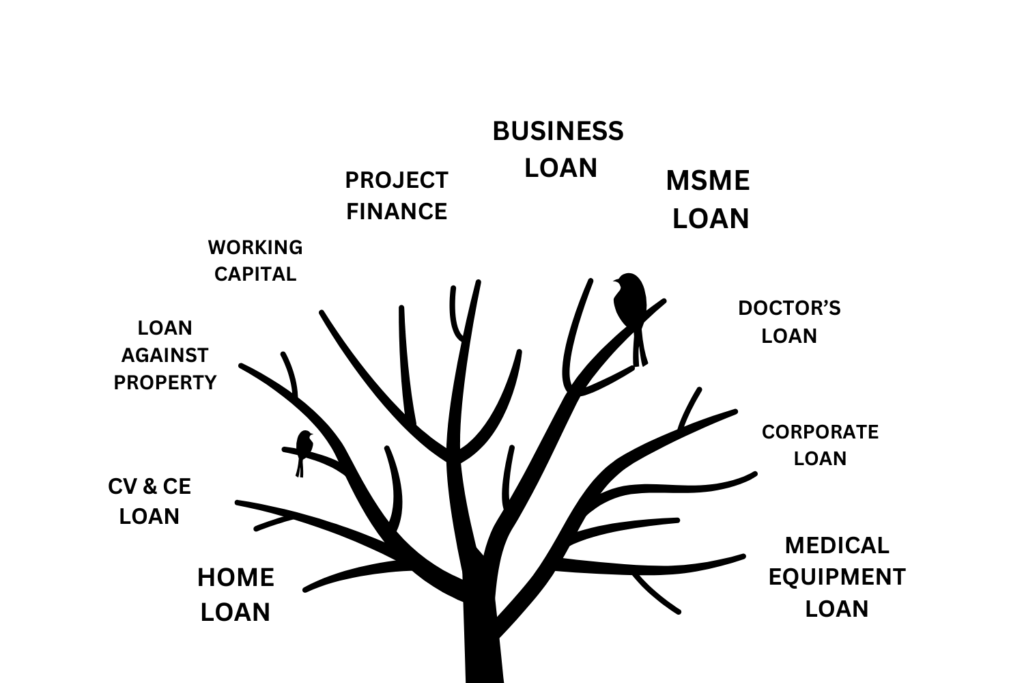

KFIS – Chennai’s No.1 Loan Distributor in Tamil Nadu Home Business Loan Largest Loan Distributor in Chennai, Tamil Nadu Check Eligible Need money to grow your business or manage operations? KFIS is here to help! We’re proud to be Chennai’s...

Read MoreKFIS Financial Expert Assistance outlines essential eligibility criteria for project finance. Businesses must ensure financial stability, a strong credit profile, and a well-defined project plan. Key factors include industry experience, collateral availability, and repayment capacity. Meeting these requirements enhances approval chances and streamlines the loan application process effectively.