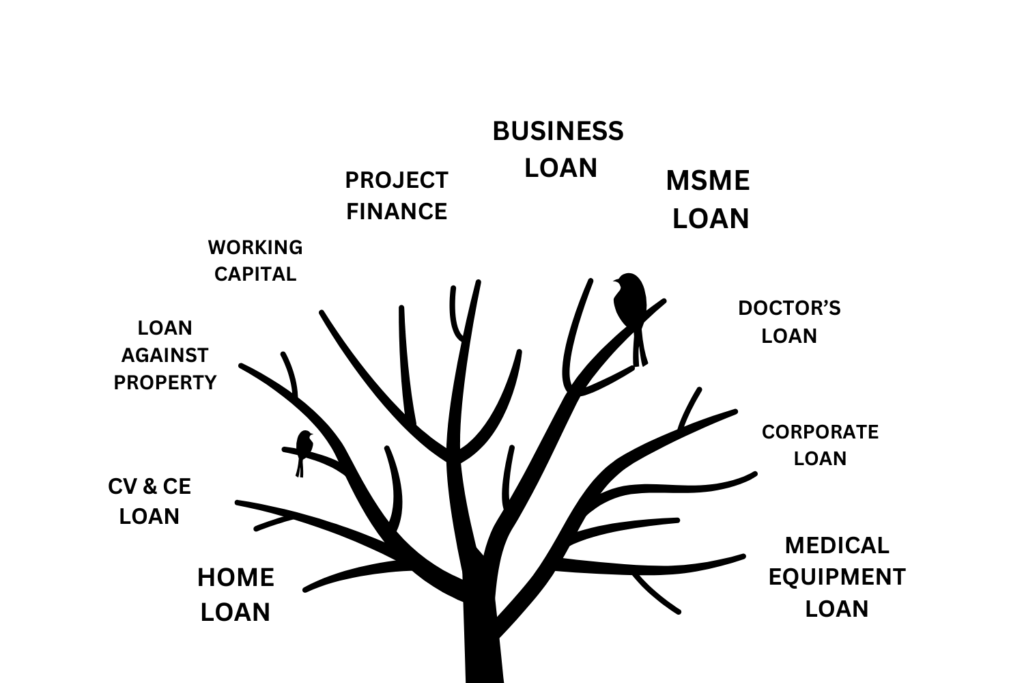

KFIS – Chennai’s No.1 Loan Distributor in Tamil Nadu Home Business Loan Largest Loan Distributor in Chennai, Tamil Nadu Check Eligible Need money to grow your business or manage operations? KFIS is here to help! We’re proud to be Chennai’s...

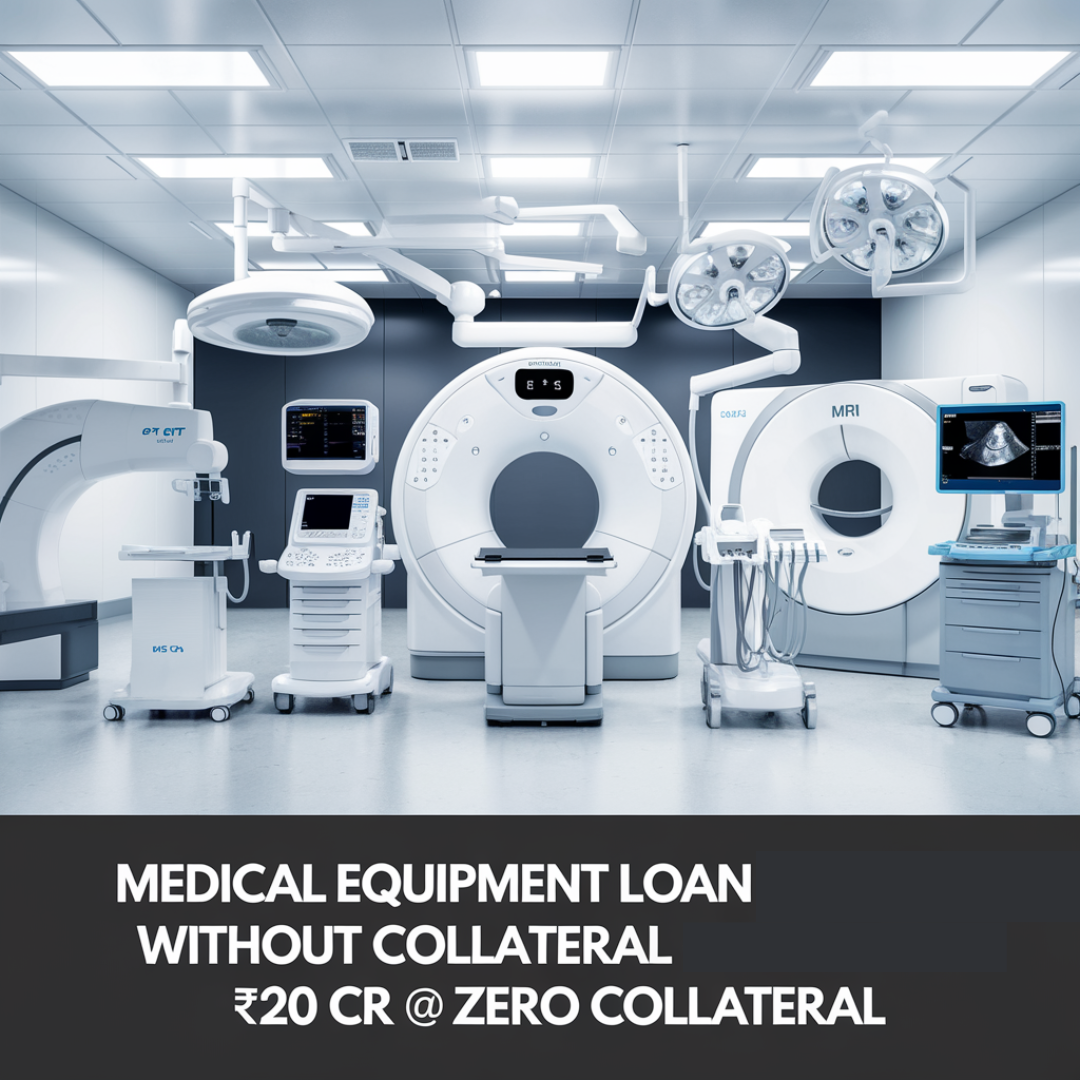

Read MoreKFIS End-to-End Finance Solutions provides hassle-free financial assistance for healthcare professionals. Eligibility Criteria For Medical Equipment Loan include a registered medical practice, stable income, and a good credit profile. Applicants need to submit necessary Documents. KFIS End-to-End Finance Solutions ensures a smooth approval process, enabling seamless equipment upgrades.