Home Blog Top 10 Manufacturing Business Ideas in India A Comprehensive Guide to Thriving Industries India, with its rapidly growing economy and vast consumer base, has become one of the world’s most attractive destinations for businesses. The manufacturing sector in...

Read MoreBusiness Loans in Chennai

Anywhere in Chennai, No Limits

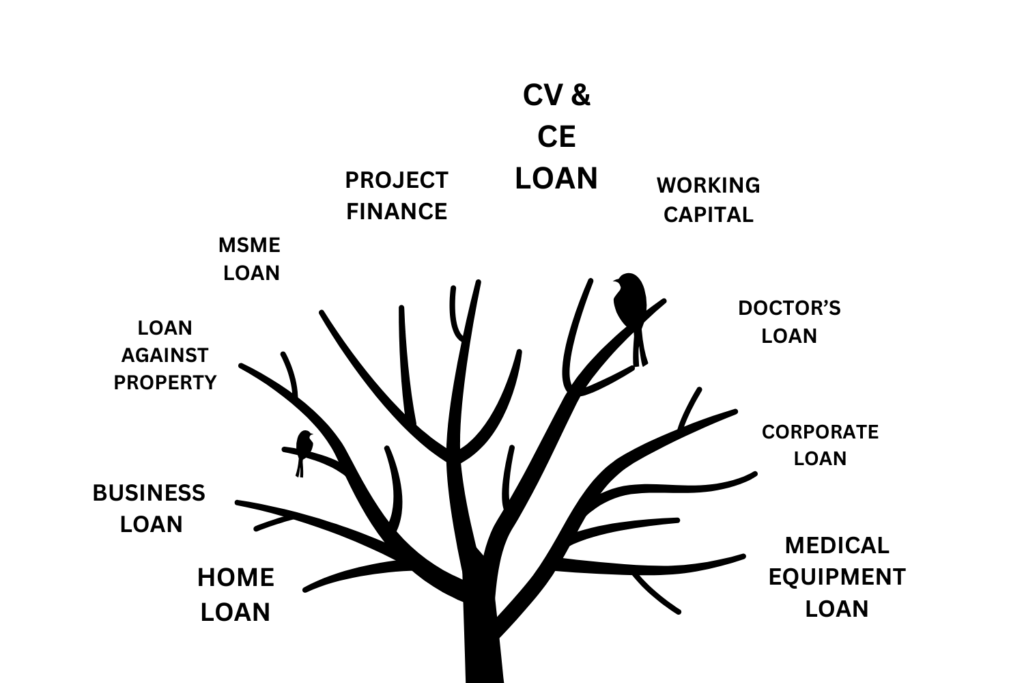

Expand Bigger, Grow Smarter with Maximum Finance

This Is The Right Time To