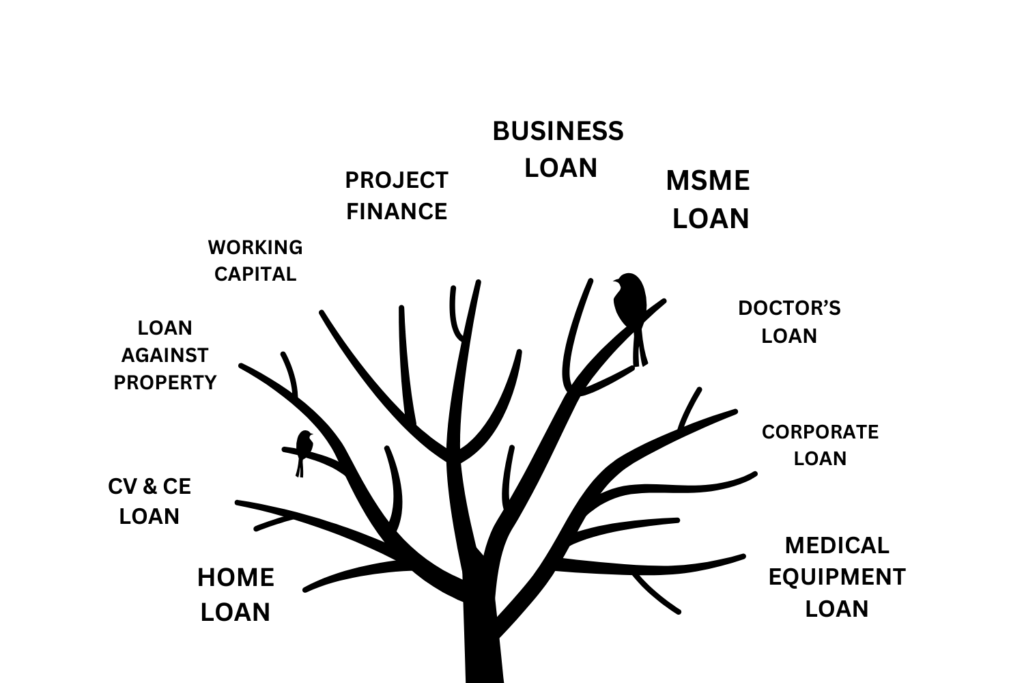

KFIS – Chennai’s No.1 Loan Distributor in Tamil Nadu Home Business Loan Largest Loan Distributor in Chennai, Tamil Nadu Check Eligible Need money to grow your business or manage operations? KFIS is here to help! We’re proud to be Chennai’s...

Read MoreWhen applying for a loan against property, it’s important to understand the Eligibility Criteria For Loan Against Property For Self Employed Customers. At KFIS Financial Consulting, we simplify the process to help you secure a loan. Meeting these requirements ensures a smooth approval process.