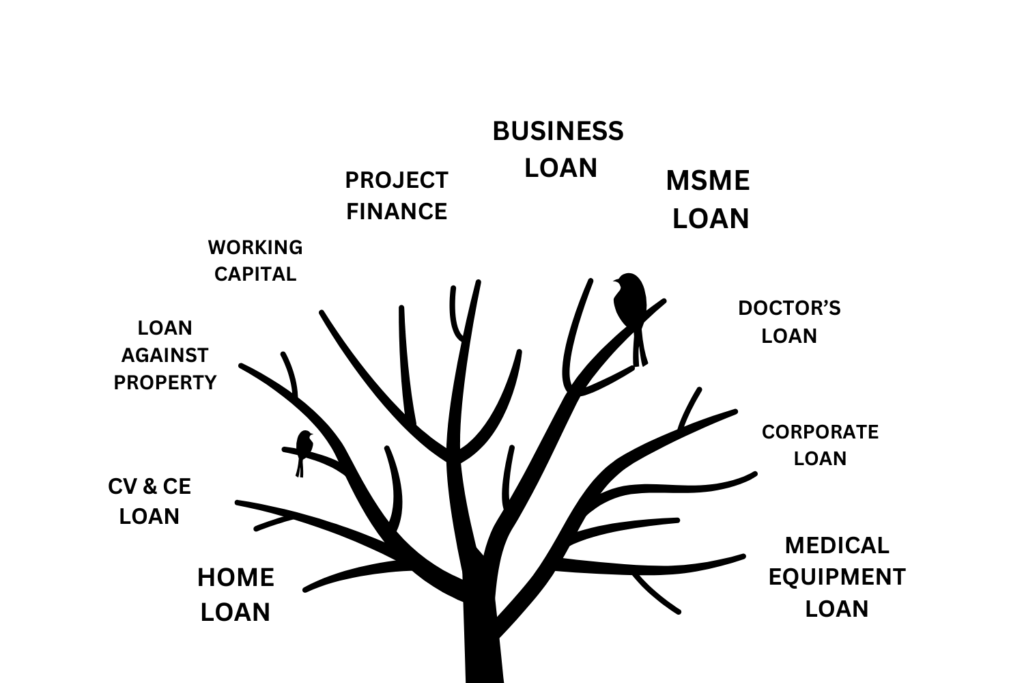

KFIS – Chennai’s No.1 Loan Distributor in Tamil Nadu Home Business Loan Largest Loan Distributor in Chennai, Tamil Nadu Check Eligible Need money to grow your business or manage operations? KFIS is here to help! We’re proud to be Chennai’s...

Read MoreAt KFIS Elite Financial Solutions, the eligibility criteria for home loan for self-employed & salaried individuals depend on factors like income stability, credit score, and debt-to-income ratio. Meeting these requirements ensures a smooth application process and faster loan approval.