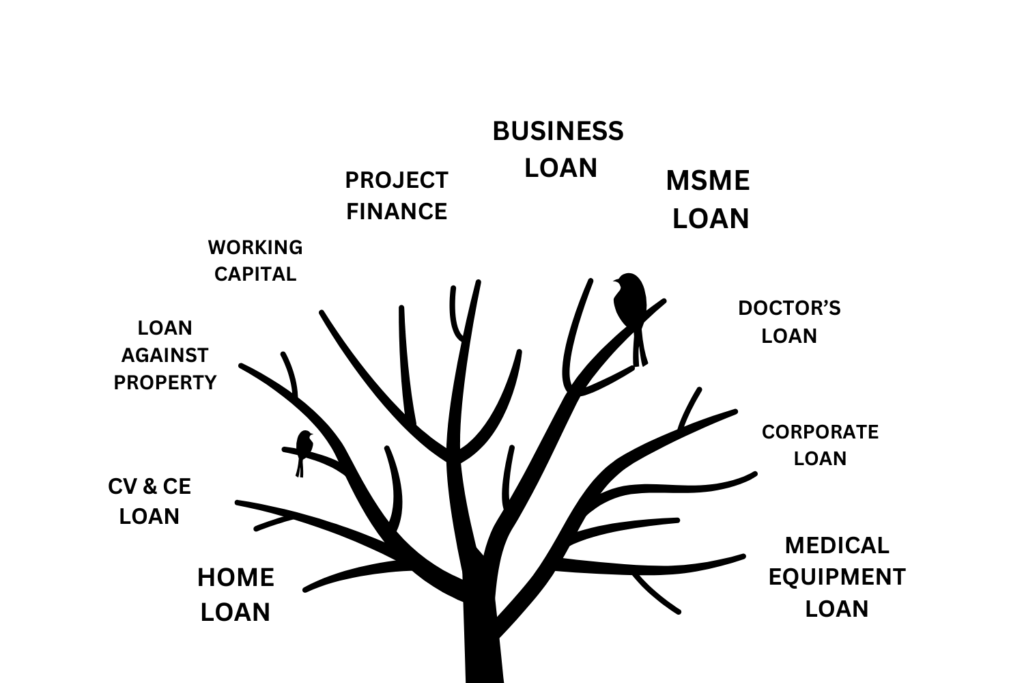

Need money to grow your business or manage operations?

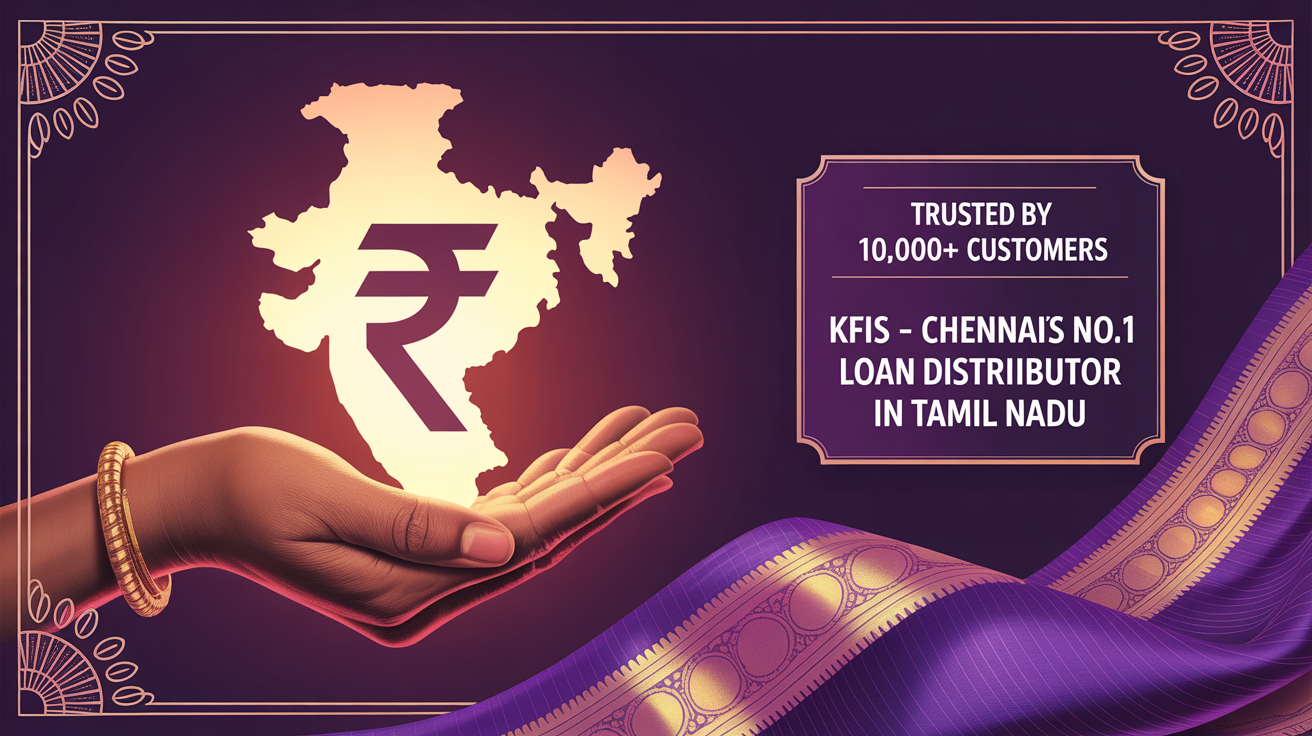

Read MoreKFIS Premier Loan Services outlines the eligibility criteria for business loan in Maraimalai Nagar. To qualify, businesses must have a solid financial history, at least one year of operation, and provide necessary documents like tax returns and income statements.