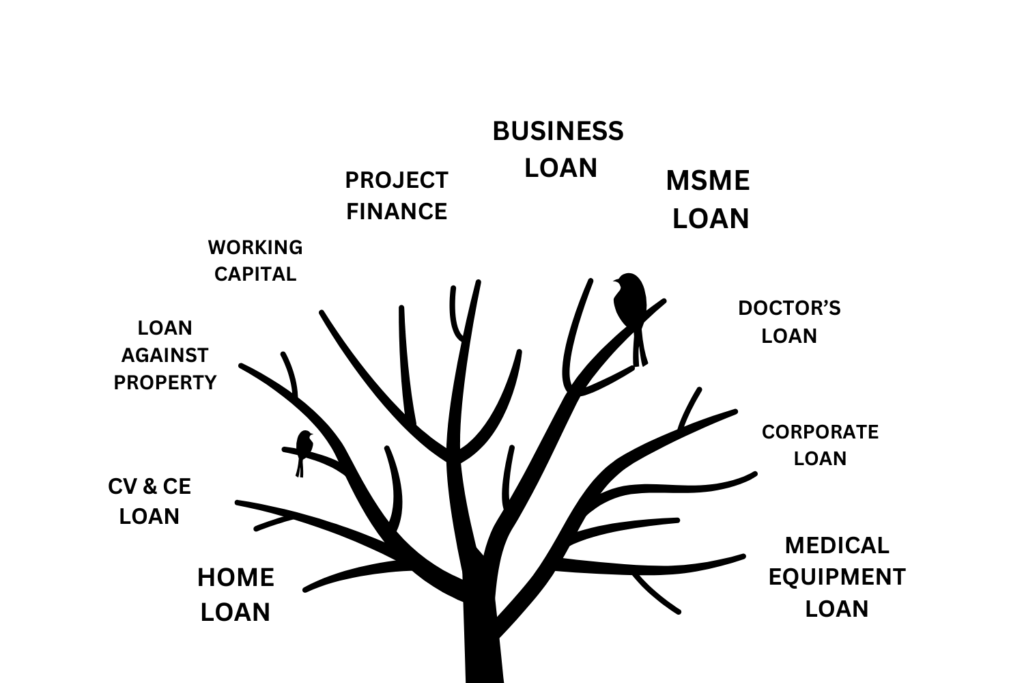

KFIS – Chennai’s No.1 Loan Distributor in Tamil Nadu Home Business Loan Largest Loan Distributor in Chennai, Tamil Nadu Check Eligible Need money to grow your business or manage operations? KFIS is here to help! We’re proud to be Chennai’s...

Read MoreWhen applying for an industrial equipment loans, understanding the eligibility criteria for industrial equipment loan is simplified by KFIS Professional Financial Solutions helps businesses secure loans to acquire the necessary equipment for growth. Key factors include the business’s operational history, financial health, and the purpose of the equipment.