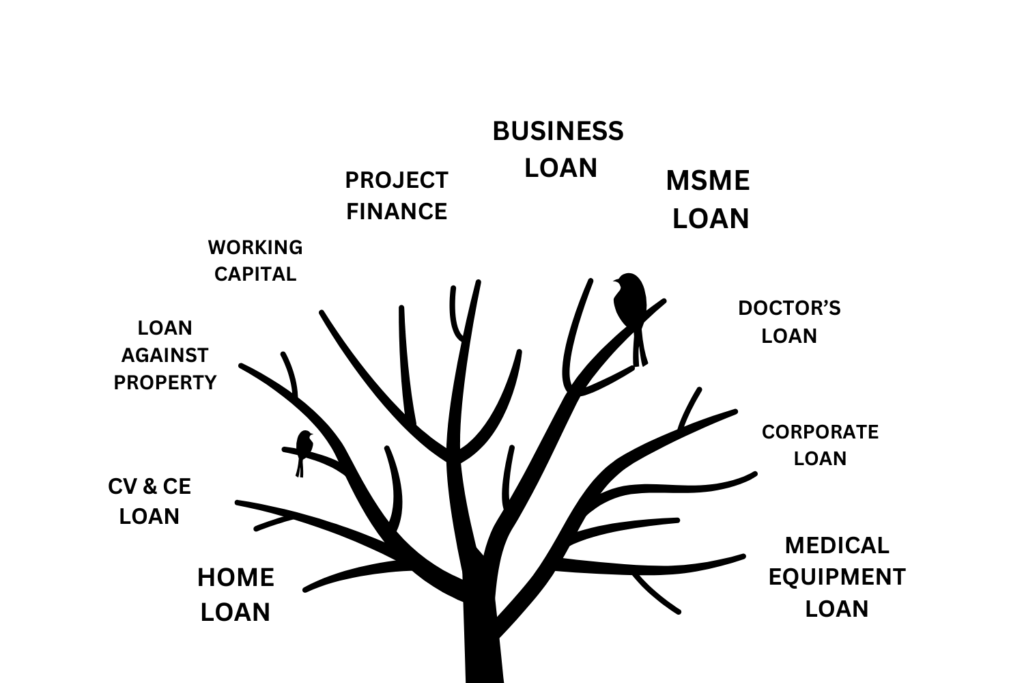

Need money to grow your business or manage operations?

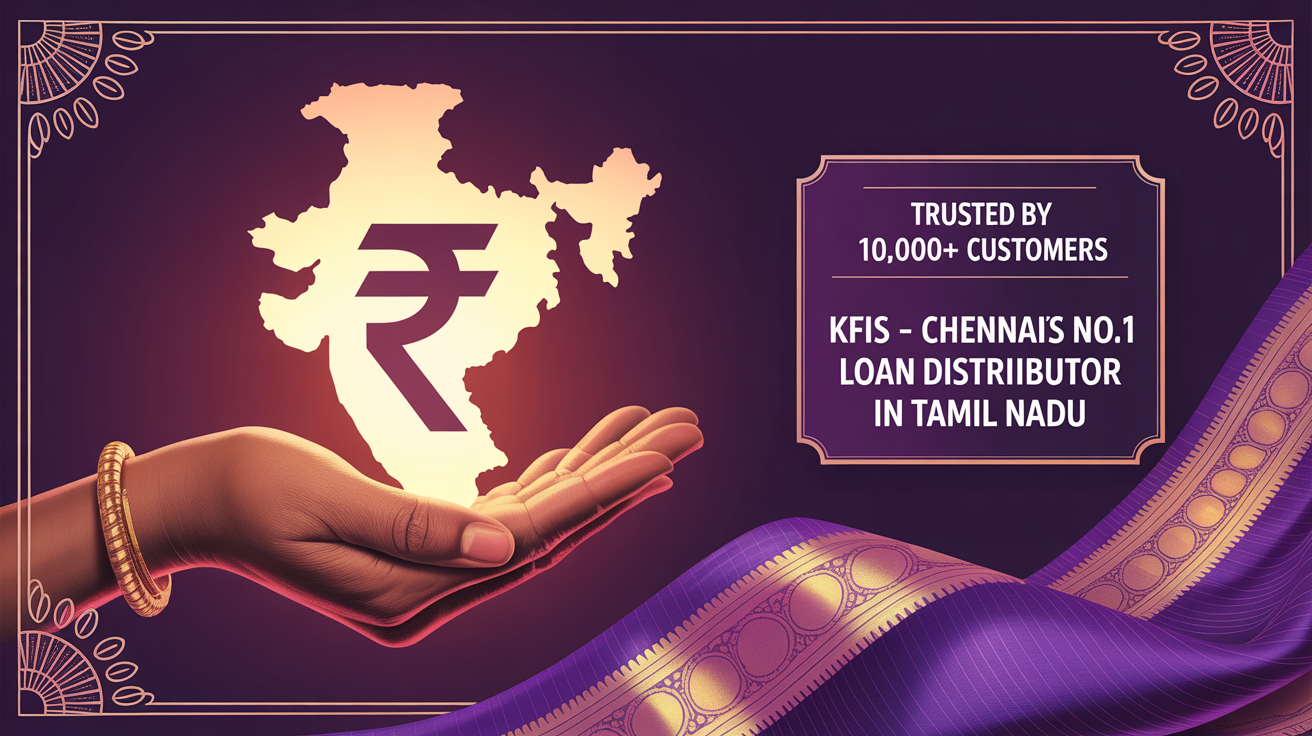

Read MoreUnderstanding the eligibility criteria for business loans in Trichy is crucial when applying for financial assistance. KFIS Experts Service helps businesses meet these requirements, which typically include having at least 2+ years of operation, stable revenue, and a good credit score. Meeting these conditions can improve your chances of securing a business loan.