Managing a loan isn’t just about paying EMIs on time. It’s about choosing the smartest EMI repayment strategy that helps you reduce the maximum amount of interest over the entire tenure. Understanding the difference between loan repayment, Part Pre Payment, and loan pre closure can help you save thousands or even lakhs eventually.

Many borrowers don’t realize how much they can save simply by making strategic moves early. Let’s break it down in a human, simple, and practical way so you can choose the best method for your financial situation.

Loan repayment is the standard process of paying the lender back through EMIs each month. Every EMI contains two components:

In the beginning, the EMI is heavily interest loaded. This is why understanding your EMI interest calculation is so important. During the first few years, almost 70–80% of your EMI goes toward interest rather than reducing your principal. Only in the later years does your EMI start reducing the actual loan amount efficiently.

Because the initial EMIs contain more interest, this is exactly the best time to make additional payments if you want to save the maximum amount of interest.

Part Pre Payment (also known as part payment or loan prepayment) means paying an extra lump sum amount toward your loan in addition to your regular EMI. This is one of the most effective ways to reduce your loan burden.

For example:

If your EMI is ₹20,000 per month and you get a bonus of ₹50,000, you can use that amount as a prepayment option.

When you make a part prepayment:

If you prepay ₹1 lakh on a home loan early in your tenure, you may save ₹1.5–2 lakh in interest over time.

Part prepayment is one of the smartest and most flexible strategies to reduce total interest.

Loan pre closure or foreclosure means paying off the entire remaining loan amount in one shot before the end of the tenure. After this, you don’t have to pay EMIs anymore.

However, depending on your loan type, there may be loan foreclosure charges.

When should you consider Pre Closure?

Pre closure works best when your remaining tenure is long enough for interest savings to matter.

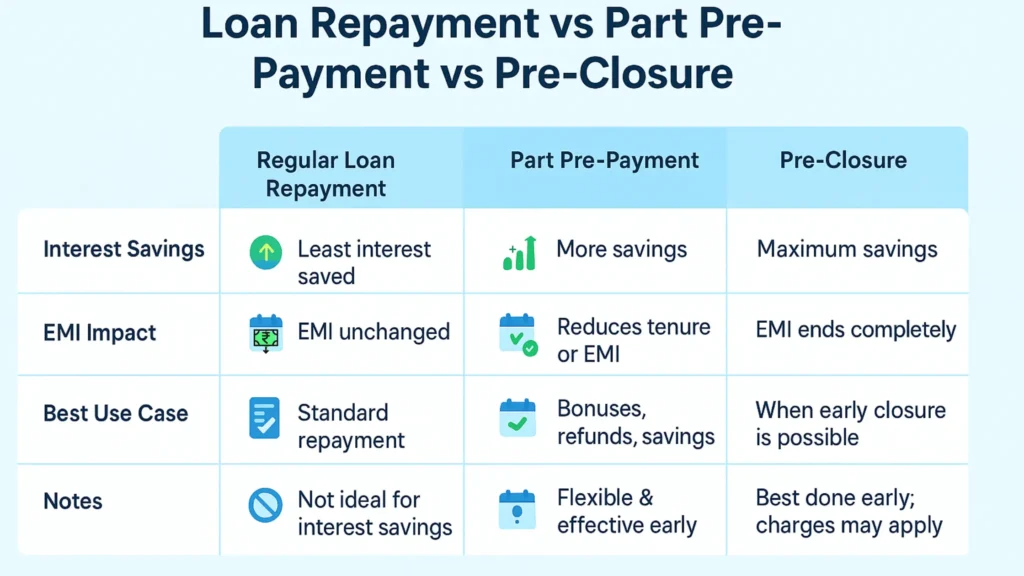

Let’s compare these three strategies from the viewpoint of saving the maximum amount of interest.

The best strategy depends on your income, financial goals, and loan type. But here’s a simple and proven rule:

Here’s how it works:

Even ₹10,000–20,000 once a year makes a huge difference.

This reduces your principal and interest burden right away.

Once you have enough money to close the loan, check:

If everything looks good, foreclosing early can save years of interest.

Understanding your EMI calculation is essential because:

Most financial experts recommend choosing tenure reduction during prepayment it saves far more interest.

This approach ensures you save the maximum amount of interest while staying financially secure.

Choosing between loan repayment, Part Pre Payment, and loan pre closure doesn’t have to be confusing. If your goal is to save the maximum amount of interest, the winning formula is simple: combine smart Part Pre Payments early with Pre Closure at the right time. This reduces your EMI burden, cuts down interest drastically, and helps you become debt free faster.

Part pre-payment is when you pay an extra amount toward your loan principal while continuing regular EMIs. Pre-closure means you pay off the entire remaining loan balance at once, ending the loan completely.

Pre-closure saves the maximum interest because you stop all future EMIs. Part pre-payment also saves significant interest by cutting down the principal early, which reduces the total interest charged over the tenure.

The best time for part pre-payment is early in the loan tenure, ideally within the first 1–5 years. Interest is front-loaded in most loans, so paying early reduces long-term interest the most.

Lenders offer two options: reduce EMI or reduce tenure. Choosing tenure reduction saves more interest because your loan gets paid off faster, minimizing total interest.

Part pre-payments usually save more interest because the extra money directly reduces your principal. Higher EMIs help, but the impact is smaller compared to lowering the outstanding balance.

For floating-rate home loans, most banks do not charge fees. However, fixed-rate loans, personal loans, and some regional lenders may apply a pre-payment or pre-closure fee. Always check your loan agreement before paying.

Yes, pre-closure can positively impact your credit score because it reduces your overall debt. However, maintaining consistent on-time EMI payments also builds a strong credit history.

Most lenders allow unlimited part pre-payments throughout the loan tenure. Even small but frequent pre-payments can significantly reduce your interest burden.

Pre-closing a high-interest loan like a personal loan or credit card makes financial sense. For low-interest loans, consider whether keeping the money for emergencies or investments might offer better returns.

The most effective strategy is making regular EMIs plus periodic part pre-payments early in the tenure. If you have enough surplus funds and no better investment alternatives, pre-closure offers the highest overall interest savings.

The information provided on this blog is for general informational and educational purposes only and is not intended as financial, investment, or legal advice. While we strive to ensure the accuracy and reliability of the information shared, we make no guarantees of completeness, accuracy, or timeliness. You should not rely solely on this information when making financial decisions. Always consult with a qualified financial advisor or professional before making any financial or investment decisions. The views expressed are personal opinions and do not represent any official stance of financial institutions or partners. Use of this site and its content is at your own risk.