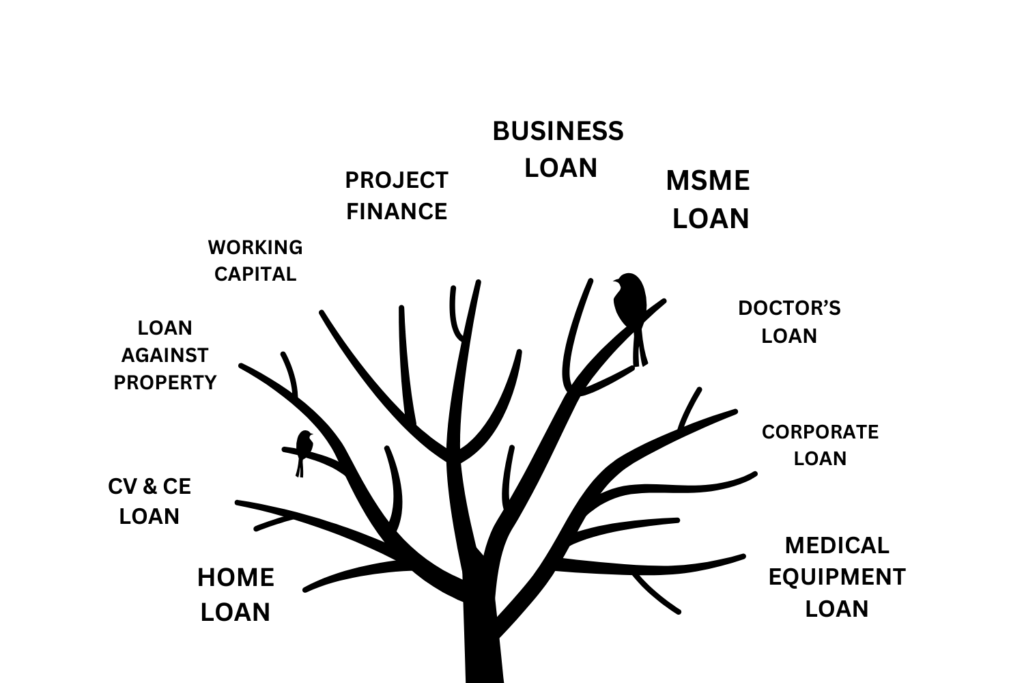

KFIS – Chennai’s No.1 Loan Distributor in Tamil Nadu Home Business Loan Largest Loan Distributor in Chennai, Tamil Nadu Check Eligible Need money to grow your business or manage operations? KFIS is here to help! We’re proud to be Chennai’s...

Read MoreKFIS Trusted Finance Service provides clear guidelines on the eligibility criteria for business loans in Tambaram, ensuring that entrepreneurs can easily navigate the application process. Understanding these requirements can significantly increase your chances of approval.