Running a business requires the right financial support at the right time. Whether you want to expand operations or simply maintain smooth daily cash flow, choosing the right loan makes a huge difference. Among the most popular options available for businesses, Term Loans and Working Capital Loans stand out as two essential financial tools.

While both fall under business financing, they serve completely different purposes, come with different repayment structures, and impact your company’s financial health in different ways. In this blog, we’ll break down the difference between a term loan and a working capital loan, helping you understand which one is best suited for your business needs.

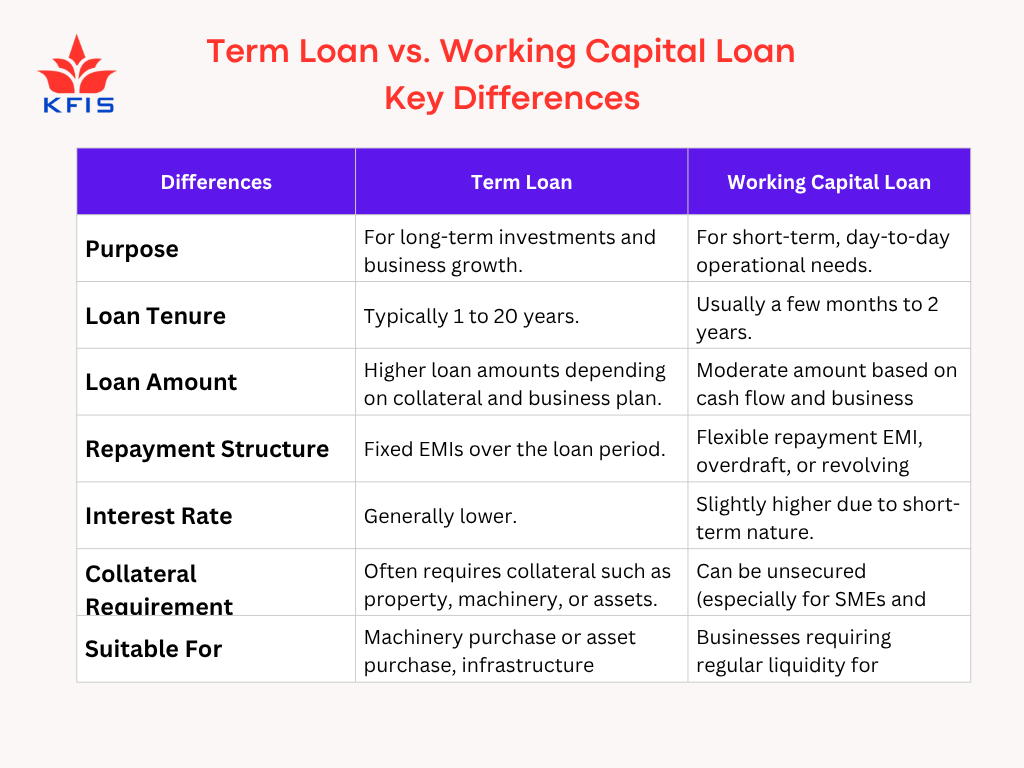

A Term Loan is a long term business loan offered for a specific purpose such as expansion, asset purchase, modernization, or setting up new facilities. Borrowers receive the entire loan amount upfront and repay it in fixed installments over a set period.

Features of a term loan:

Common uses:

Term Loans are perfect when you want stable funding for long term growth.

A Working Capital Loan is a short term business loan designed to manage day to day operational expenses. This type of loan ensures that your business never faces a cash crunch during its regular operations.

Features of a working capital loan:

Common uses:

Working Capital Loans are essential for businesses that need quick liquidity to maintain smooth operations.

A Working Capital Loan is a short term business loan designed to manage day to day operational expenses. This type of loan ensures that your business never faces a cash crunch during its regular operations.

Features of a working capital loan:

Common uses:

Working Capital Loans are essential for businesses that need quick liquidity to maintain smooth operations.

Let’s say you run a manufacturing business in Chennai. You need ₹25 lakh to buy a new machine that will increase production capacity. This is a long-term investment.

In this case, a Term Loan is the right choice.

On the other hand, you’re short of funds to pay for raw materials and employee salaries during peak season. You need quick money to keep operations running.

Here, a Working Capital Loan is the perfect fit.

Selecting the right loan not only supports immediate requirements but also boosts long-term business growth. Here’s what you gain:

When businesses choose the right financing option, they grow faster and manage risks better.

Both Term Loans and Working Capital Loans play important roles in business finance, but they cater to different needs. If you are planning future growth, upgrading assets, or expanding operations, a Term Loan gives you the financial strength to move forward. But if your business needs quick liquidity for daily operations, payroll, or cash flow management, a Working Capital Loan is your best option.

By understanding your business goals, financial capacity, and repayment preference, you can confidently decide which loan is right for your business.

Trustindex verifies that the original source of the review is Google. I had the privilege of working with Khannan from KFIS for project finance services in Chennai. His expertise and guidance made the entire process seamless. He explained every step clearly and helped us secure the right funding for our project. Highly recommended! By N. S. Nirmal from NSK BuilderTrustindex verifies that the original source of the review is Google. Really so good service Good helping personsTrustindex verifies that the original source of the review is Google. Best Business Loan Service Providers in Chennai. From application, document sorting and financial advice they are experts. Thanks to Khannan Finance.Trustindex verifies that the original source of the review is Google. Kfis has been a lifesaver for my business! Their Unsecured Business Loan in Chennai was approved in just 72 hours, allowing me to invest in essential equipment without any collateral. The team was supportive and guided me through every step of the process. Highly recommend their services!Trustindex verifies that the original source of the review is Google. Kfis offers the best business loans in Chennai! Their quick approval and flexible repayment options helped me manage my cash flow effectively. 💼Verified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

What is the main difference between a term loan and a working capital loan?

A term loan supports long term business growth like expansion or machinery purchase, while a working capital loan helps manage daily operational needs, cash flow gaps, inventory, and short term expenses. Both are essential for SMEs and MSMEs in India.

Which loan is better for small businesses in Chennai?

Small businesses in Chennai benefit from working capital loans for day to day expenses, while term loans suit long term investments and expansion. The right choice depends on whether your goal is improving cash flow or funding major upgrades.

Is a working capital loan suitable for managing seasonal cash flow issues?

Yes, a working capital loan is ideal for businesses facing seasonal fluctuations. It supports inventory purchase, vendor payments, salaries, and short-term expenses during peak demand or delayed customer payments, making it highly suitable for SMEs and traders.

When should a business choose a term loan?

A business should choose a term loan when planning expansion, upgrading machinery, opening new branches, or investing in long-term assets. It offers structured EMIs, longer tenure, and stable financing for projects contributing to long-term growth and profitability.

Are working capital loans available without collateral?

Many lenders offer unsecured working capital loans to SMEs and MSMEs, especially those with strong financials. These loans help businesses manage operational needs like stock purchase, payroll, and utilities without pledging property or machinery as security.

Can startups apply for a working capital loan?

Yes, startups can apply for working capital loans if they show stable revenue flow or strong future projections. These loans help manage early-stage expenses like inventory, salaries, and marketing, ensuring smooth operations during the business growth phase.

Do term loans offer lower interest rates than working capital loans?

Generally, term loans offer lower interest rates because they are long-term and often secured with collateral. Working capital loans may carry slightly higher rates due to short tenure and quick disbursal, making them ideal for urgent liquidity needs

Which loan is faster to get approved: term loan or working capital loan?

Working capital loans usually get approved faster because they focus on short-term operational needs, require minimal documentation, and are often unsecured. Term loans take longer due to asset evaluation, project analysis, and collateral verification.

Can Chennai-based manufacturers apply for both loan types?

Yes, manufacturers in Chennai can apply for both term loans for machinery and infrastructure, and working capital loans for raw material purchase, workforce payments, and operational expenses. Using both helps maintain smooth production and long-term growth.

How do I decide whether my business needs a term loan or working capital loan?

Choose a term loan if you need long-term investment for expansion or assets. Choose a working capital loan if you need quick liquidity for daily operations, cash flow gaps, or seasonal demand. Assess goals, repayment ability, and urgency.

The information provided on this blog is for general informational and educational purposes only and is not intended as financial, investment, or legal advice. While we strive to ensure the accuracy and reliability of the information shared, we make no guarantees of completeness, accuracy, or timeliness. You should not rely solely on this information when making financial decisions. Always consult with a qualified financial advisor or professional before making any financial or investment decisions. The views expressed are personal opinions and do not represent any official stance of financial institutions or partners. Use of this site and its content is at your own risk.